How to Calculate Gross Income for the PPP

Editor’s note: On Tuesday, May 4th the PPP ran out of general funds and the SBA stopped accepting new PPP loan applications. A reserve of funds is still available for community financial institutions that lend to businesses run by women, minorities, and underserved communities. Additionally, a reserve of funds remains for applications previously submitted but not yet reviewed by the SBA. If you have already submitted your loan application, however, this does not guarantee you funding.

Figuring out your gross income for the Paycheck Protection Program (PPP) loan application doesn’t have to be complicated. As a finance guru, let me walk you through the key steps so you can get this right.

First things first – what counts as gross income? We’re talking total revenue, sales, receipts – whatever you want to call it – before removing any expenses, taxes, returns etc. Got it? Good.

Now, pick your time frame. You can use either your 2019 or 2020 gross income numbers. Choose whichever year shows your business in the best light. If you were pumping out products or services all of 2019 but took a break in 2020, go with 2019. If you’re a new biz who just opened up shop in 2020, use this past year. Make sense so far?

Here’s where we get a bit math-y. Take that full year’s gross income and divide it by 12 months. This gives you the average monthly gross income figure you need. Stay with me…almost there!

Final step – multiply that monthly average by 2.5. Boom – that’s your max PPP loan amount! Wasn’t so hard right?

I know you savvy entrepreneurs have got this, but let me sprinkle in some bonus tips:

- Every number you report should be verifiable with tax docs or bank statements. No funny business!

- New biz? Different calculation for you.

- Farmers, ranchers, freelancers – special rules apply to you too.

There you have it folks – the inside scoop on calculating gross income for the PPP fast loan. Let me know if you need me to explain anything in more detail. I’m here to help you get those dollars!

On February 22, President Joe Biden announced changes to the Paycheck Protection Program (PPP) including allowing the self-employed to apply using their gross income. But what is gross income and how will it change your PPP loan amount calculation?

How to calculate your PPP loan amount using gross income

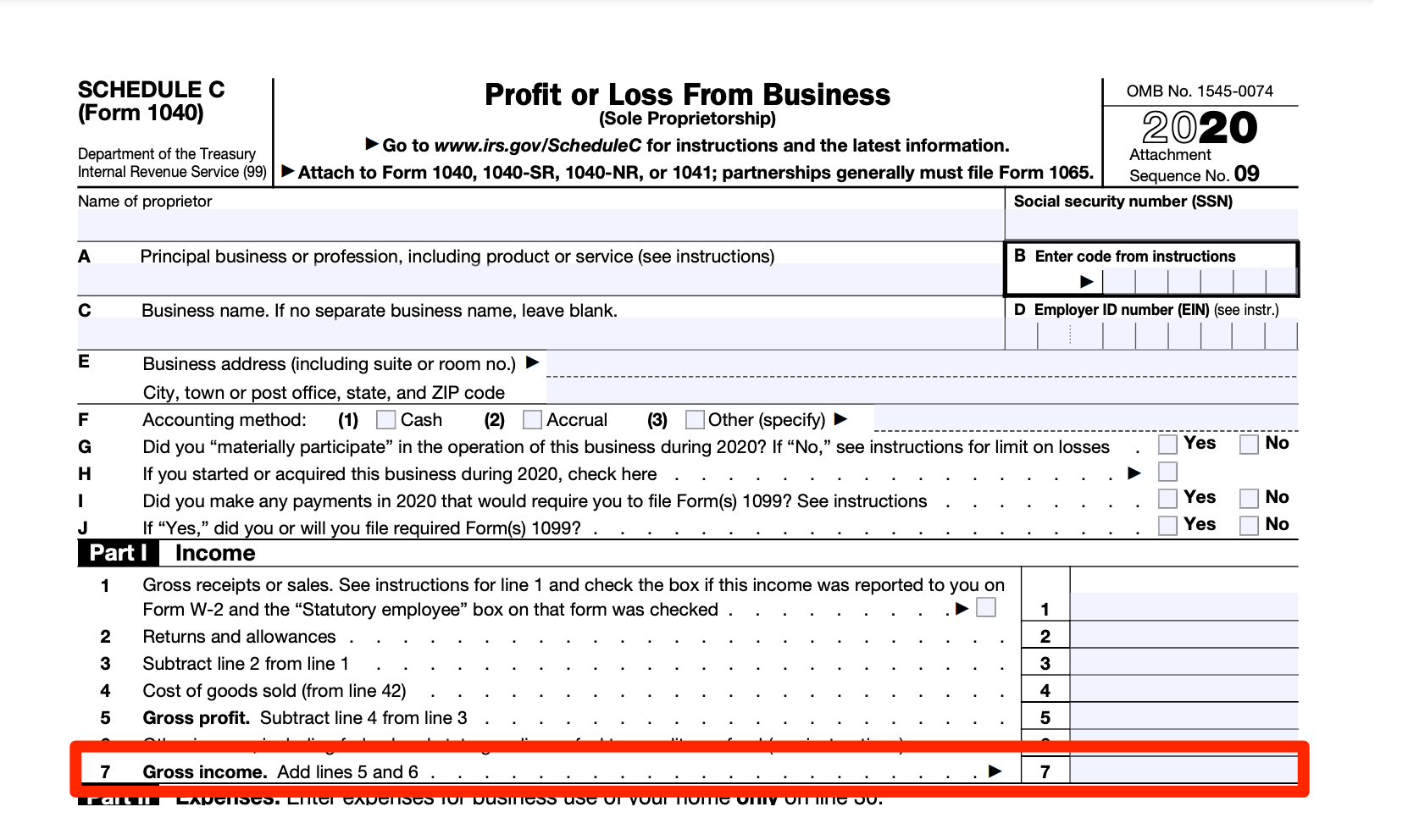

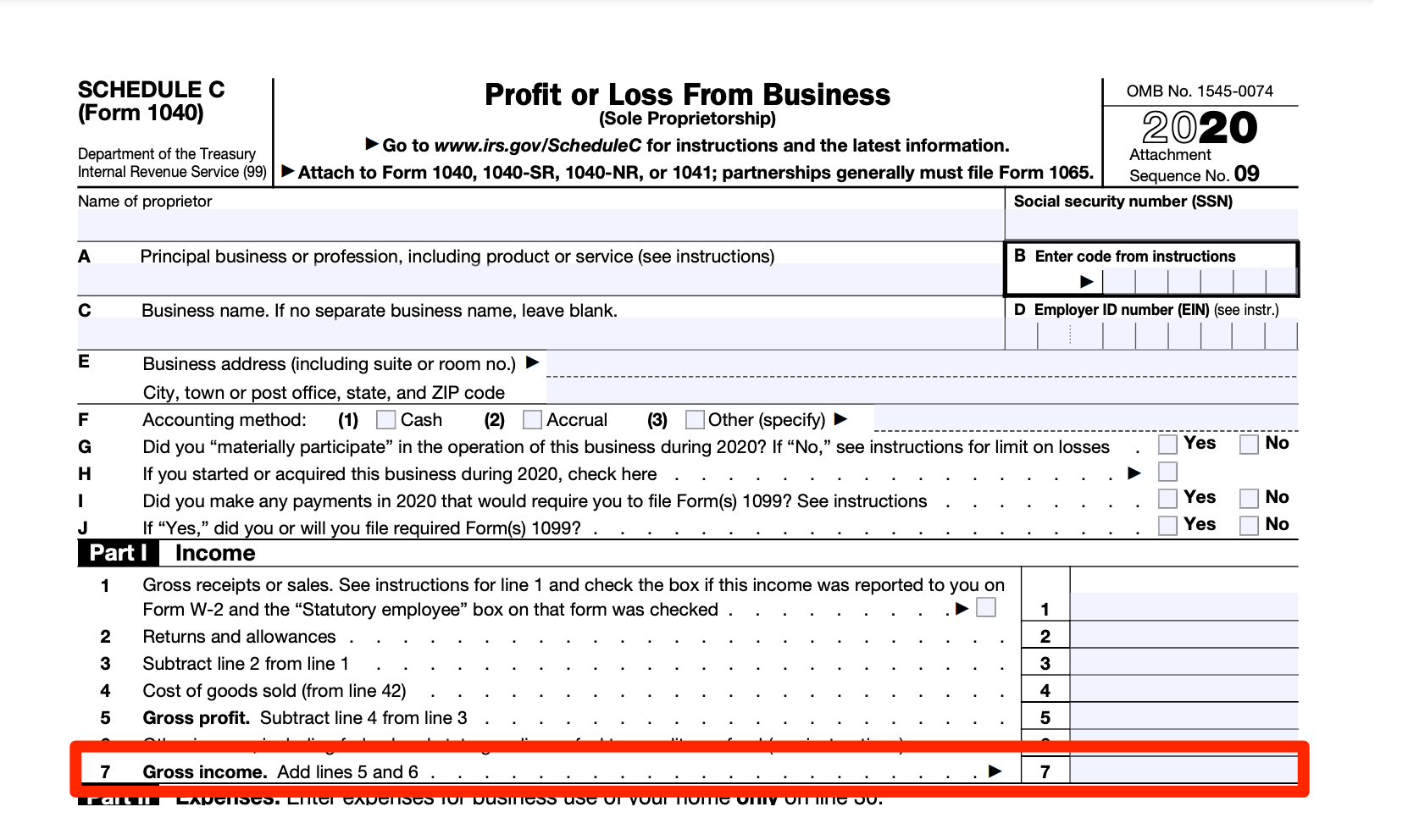

There are two calculations: one for sole proprietors with payroll and one for sole proprietors without payroll. For now, only the self-employed who file a Schedule C will be eligible to use gross income for their PPP loan amount calculation.

Sole proprietors without payroll

Sole proprietors with payroll

If you are running payroll for either yourself or employees, you will need to subtract payroll costs from your gross income. All of this information can still be found on your Schedule C.

Here are the steps to calculating your PPP loan amount as a sole proprietor with payroll: Take your gross income as reported on line 7 of your 2019 or 2020 Schedule C.

- Subtract any payroll costs as reported on lines 14, 19, and 26 of your 2019 or 2020 Schedule C. If this value is greater than $100,000 (the maximum allowed amount), use $100,000.

- Add in the gross wages and tips paid to employees based in the United States for 2019 or 2020. This can be calculated using line 5c, column 1 of IRS Form 941.

- Add in any pre-tax employee contributions for health insurance. Subtract any values in excess of $100,000 per employee.

- Add in employer contributions to employee group health, life, disability, vision, dental insurance, retirement contributions, and state and local taxes. (Note: Some payroll providers have reports available that will provide all the information needed for steps 3 and 4).

- Divide by 12. This is considered to be your average monthly payroll expense.

- Multiply the number from step 5 by 2.5 to find your PPP loan amount.

How to calculate your PPP loan amount using gross income

There are two calculations: one for sole proprietors with payroll and one for sole proprietors without payroll. For now, only the self-employed who file a Schedule C will be eligible to use gross income for their PPP loan amount calculation.

Sole proprietors without payroll

Sole proprietors with payroll

If you are running payroll for either yourself or employees, you will need to subtract payroll costs from your gross income. All of this information can still be found on your Schedule C.

Here are the steps to calculating your PPP loan amount as a sole proprietor with payroll: Take your gross income as reported on line 7 of your 2019 or 2020 Schedule C.

- Subtract any payroll costs as reported on lines 14, 19, and 26 of your 2019 or 2020 Schedule C. If this value is greater than $100,000 (the maximum allowed amount), use $100,000.

- Add in the gross wages and tips paid to employees based in the United States for 2019 or 2020. This can be calculated using line 5c, column 1 of IRS Form 941.

- Add in any pre-tax employee contributions for health insurance. Subtract any values in excess of $100,000 per employee.

- Add in employer contributions to employee group health, life, disability, vision, dental insurance, retirement contributions, and state and local taxes. (Note: Some payroll providers have reports available that will provide all the information needed for steps 3 and 4).

- Divide by 12. This is considered to be your average monthly payroll expense.

- Multiply the number from step 5 by 2.5 to find your PPP loan amount.

Determining Your Eligibility for PPP Funding in 2023

Collecting Your Financial Documentation

The first step is gathering all of your financial documentation from 2022. This provides the raw data needed to calculate your gross income. Be sure to gather:

- Tax returns

- Bank statements

- Bookkeeping records

- Invoices

- 1099s

- Receipts for expenses

Having clean, well-organized financial data will make calculating your gross income much simpler.

Calculating Your Gross Revenue

Once your documentation is gathered, it’s time to calculate gross revenue for 2022. This includes income from all sources related to your business or self-employment:

- Sales of products and services

- Fees, commissions, or other service charges

- Income from investments

- Rental property income

List out each stream of revenue and total it to determine your annual gross revenue for 2022. Note this figure.

Excluding Expenses from Gross Revenue

Certain tax-deductible expenses need to be excluded from gross revenue to arrive at your true gross income. For most PPP applicants, this means subtracting your cost of goods sold (COGS). COGS accounts for direct costs related to production, such as:

- Materials

- Packaging

- Shipping

- Direct labor

For farmers and ranchers, instead of COGS, exclude expenses like animal feed, seed, and other farm supplies. Fishers may subtract capital expenditures from gross profits.

Once expenses are deducted, you’re left with your gross income number.

Adjusting for Self-Employment Tax

Self-employed PPP applicants should add any deductions taken for self-employment tax when calculating gross income. These deductions should be added back to gross profits.

Accounting for Affiliates

If your business is connected with affiliates or subsidiaries, you must combine gross income for all entities to determine your PPP loan eligibility.

Averaging for Monthly Amount

With your annual gross income calculated, divide by 12 to determine your average monthly gross income for 2022. This is the key number used for PPP loan calculations.

Consult the PPP loan forgiveness application and your lender for any additional instructions related to calculating gross income. Maintain clear records of your calculations so you can verify income if requested. Accurate gross income determination is key to receiving maximum PPP loan benefits.

What is gross income?

Gross income is important because it shows how much profit you make before paying your operational expenses. Operational expenses include costs like rent, office supplies, and web hosting. These are expenses that don’t scale with production.

Think of gross income as the money you make on just the sale of a product alone. For example, if you sell ceramic mugs for $20 and the clay you use to make them costs $5, you would make $15 gross income on each sale.

Let’s say your ceramic mugs business sold 100 mugs for a gross income of 800,500 (100 x 15). Once you pay rent worth $500 and the $200 for web hosting, you’re left with $800 net income ($1500 – $500 – $200).

Because gross income does not include any operational expenses or taxes paid, your gross income will always be greater than your net income. So when thinking how to calculate gross income, know that your result should be bigger than your net income.

Resource:

https://bench.co/blog/accounting/calculate-gross-income/

https://bench.co/blog/accounting/calculate-gross-income/

https://www.calculator.net/salary-calculator.html